Somes Sound Strategy: Performance Update 7/10/2025

The Somes Sound Strategy: Current Portfolio Holdings (July 10, 2025)

The Somes Sound Strategy continues to adhere to its core mandate: compound capital through disciplined, low-volatility positioning while systematically adapting to the evolving market environment. As of July 2025, the portfolio remains just below its all-time highs, yet its structure, positioning, and past statistical behavior suggest we may be on the cusp of another upward inflection.

This update explores the current 25 holdings in detail, highlights the emergent themes across sectors and industries, and shares insight into the structural resilience designed into the strategy.

Portfolio Performance in Context

Before diving into individual names, it's worth highlighting where the strategy stands:

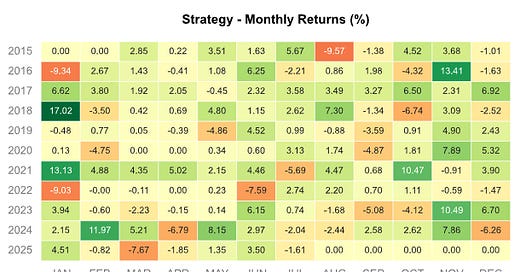

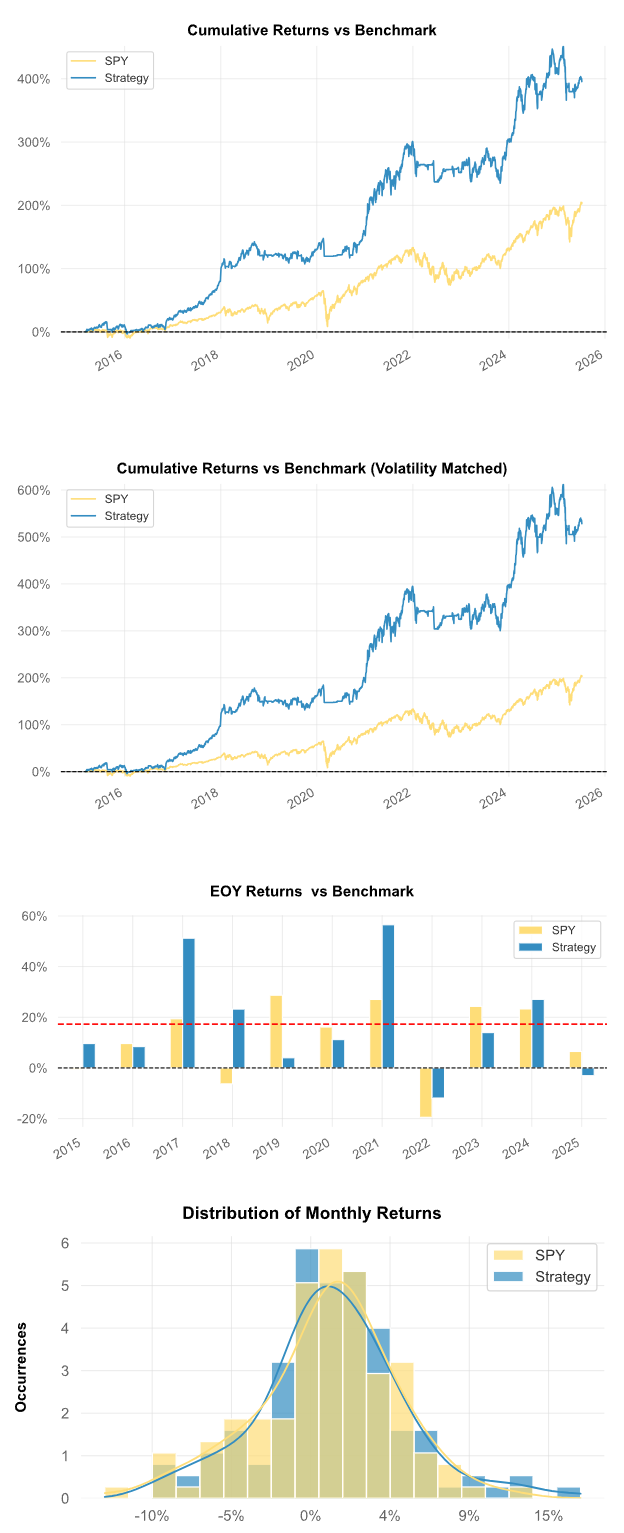

Total Return Since Inception: +396%

Annualized Return: 16.75%

Max Drawdown: -16.58%

Sharpe Ratio: 1.29

Sortino Ratio: 1.88

While recent returns have lagged broad benchmarks like the S&P 500, we interpret this as a period of digestion—a historically reliable launchpad. Previous drawdowns in rolling Sortino readings have consistently preceded strong forward returns, signaling a possible resumption of alpha generation in the near term.

Current Holdings (July 10, 2025)

RPRX, ABT, NFG, G, MP, ORLY, TMUS, WELL, YUM, EVRG, AEE, K, AEP, PM, EXC, AJG, T, BJ, WEC, KO, MPW, KR, DGX, WRB, MNST🛍️ Theme 1: Essential Infrastructure & Regulated Utilities

A pronounced feature of the current book is a deliberate overweight to utility-like assets. These include:

$EVRG (Evergy)

$AEE (Ameren)

$AEP (American Electric Power)

$EXC (Exelon)

$WEC (WEC Energy Group)

$NFG (National Fuel Gas)

$MPW (Medical Properties Trust)

$WELL (Welltower)

These names provide essential services, predictable cash flows, and frequently inflation-linked pricing mechanisms. Their inclusion reflects a market regime that continues to reward defensiveness, duration, and yield. Notably, these holdings help anchor portfolio volatility and act as a ballast during periods of dislocation or macroeconomic uncertainty.

🌿 Theme 2: Consumer Staples & Brand Power

In parallel with infrastructure exposure, there's a visible consumer defensiveness tilt, including:

$KR (Kroger)

$KO (Coca-Cola)

$K (Kellanova)

$PM (Philip Morris)

$YUM (Yum! Brands)

$BJ (BJ's Wholesale Club)

$MNST (Monster Beverage)

These names are cash-flow heavy, often have deep brand moats, and are resistant to discretionary cycles. The focus here is clear: invest in companies that retain pricing power, command habitual spending, and can manage input costs without sacrificing margin.

$MNST is particularly notable as a long-term compounder that offers a touch of growth optionality without the volatility profile of more speculative consumer names.

🏥 Theme 3: Healthcare & Diagnostics

Healthcare remains a foundational allocation within the Somes Sound Strategy:

$ABT (Abbott Laboratories)

$DGX (Quest Diagnostics)

$RPRX (Royalty Pharma)

These companies provide differentiated exposure:

$ABT brings diagnostics and medical device strength.

$DGX captures consistent lab testing revenues.

$RPRX uniquely monetizes biotech royalties—a non-correlated revenue stream with high margin potential.

This healthcare exposure is diversified across delivery, diagnostics, and IP, giving the portfolio resilience against sector-specific shocks.

📶 Theme 4: Recurring Revenue & Capital-Light Business Models

The portfolio includes several telecom, tech-service, and insurance names that benefit from scale and steady revenue:

$TMUS (T-Mobile)

$T (AT&T)

$G (Genpact)

$WRB (W.R. Berkley)

$AJG (Arthur J. Gallagher)

These businesses have sticky customer bases, recurring contracts, and operate in markets with high barriers to entry. In particular:

$G provides tech-enabled business process outsourcing.

$WRB and $AJG are capital-efficient insurers and brokers with outstanding underwriting records.

Such names act as low-volatility growth anchors, compounding returns without overreliance on macro tailwinds.

⚖️ Theme 5: Idiosyncratic, Non-Correlated Growth

A few positions exist as asymmetric growth or diversification plays:

$ORLY (O'Reilly Automotive): Industry leader in auto parts, with strong buyback and margin profiles.

$MP (MP Materials): A rare earths exposure, with geopolitical optionality and strategic scarcity.

These names introduce convexity without undermining the portfolio's defensive core.

Summary of Strategic Positioning

Looking Ahead

The Somes Sound Strategy is currently navigating what we view as a healthy consolidation phase. This pause is not a signal of weakness but a reflection of market digestion — and an opportunity to rotate into next-cycle leadership.

Historical analogs suggest that Sortino compression at these levels often precedes strong upside runs. With a portfolio tilted toward defensiveness but seeded with quiet compounders, we believe the current holdings position us well for the next regime shift.

Final Thoughts

We remain committed to a systematic, evidence-based approach that avoids hype, minimizes drawdown, and compounds capital through both calm and chaos. This current portfolio reflects that ethos — resilient, pragmatic, and built to endure.

Subscribe to stay updated on portfolio changes, performance reports, and forward-looking regime shifts.